In markets where customers compare prices with a few clicks, competitive pricing has evolved from a reactive tactic into a strategic discipline.

The challenge isn't simply matching competitor rates, it's understanding when to compete on price, how to do it without eroding margins, and which battles are worth fighting.

Competitive pricing sets prices based primarily on competitor pricing rather than costs or customer value alone.

In 2026, this approach has become both more sophisticated and more perilous. Real-time price intelligence, algorithmic competitors, and price-savvy customers have raised the stakes. This guide provides the framework pricing managers need to deploy competitive pricing strategically covering when it creates advantage, how to implement it without destroying value, and the critical mistakes that turn it into a margin killer.

Understanding Competitive Pricing

Competitive pricing is a market-oriented strategy where prices are set primarily in reference to competitor pricing levels, rather than being determined solely by internal costs or customer willingness to pay. The strategy assumes that market prices reflect collective wisdom about value and that positioning relative to these prices influences purchase decisions.

Why competitive pricing has intensified:

- Price transparency has reached unprecedented levels. Comparison engines, review sites, and AI shopping assistants make competitive analysis instantaneous for customers

- Feature parity in many product categories has reduced differentiation and elevated price as a decision factor

- Marketplaces and aggregators create environments where side-by-side price comparison is the default shopping experience

For pricing managers, competitive pricing directly addresses market positioning. A price that's 15% above the market leader signals something different than one that's 15% below.

The question isn't whether competitors influence your pricing, they already do through customer comparison but whether you're managing that influence strategically.

Examples from Real Businesses

Amazon's algorithmic repricing adjusts millions of prices daily based on competitor moves, inventory levels, and conversion data. The sophistication isn't in matching prices it's in knowing when to match, when to undercut by a dollar, and when to hold premium positioning because conversion data shows customers are buying on delivery speed, not price.

Generic pharmaceutical pricing illustrates competitive pricing in commoditized markets. When drugs go off-patent, generic manufacturers typically price 20-40% below branded versions initially, then converge toward parity as markets mature. The competitive dynamic isn't about undercutting each other, it's about signaling "equivalent quality" while capturing margin.

SaaS tool positioning in crowded categories shows strategic competitive pricing. Project management tools cluster around specific price points ($10/user, $25/user, $50/user) because these represent customer reference points. New entrants often price slightly below category leaders to signal "similar value, better deal," but rarely undercut by more than 20% without triggering quality concerns.

These examples share a pattern: competitive pricing works when it aligns with how customers actually compare and evaluate, not when it simply copies competitor price lists.

Pros and Cons of Competitive Pricing

Advantages of Competitive Pricing

Market entry velocity: Competitive pricing provides new entrants with an immediate positioning framework. Rather than spending months on customer research for value-based pricing, companies can price relative to established players and begin generating revenue.

Customer acquisition in price-transparent markets: When customers actively compare prices before buying, competitive pricing reduces purchase friction. A B2B software company priced 10% below category leaders will capture evaluation opportunities they'd miss at parity.

Simplified decision-making: In organizations where pricing governance is slow, competitive pricing provides an external anchor that cuts through internal debate. "We're priced at 95% of [competitor]" is easier to approve than complex value-based calculations.

Volume capture in elastic markets: For products where small price differences drive significant volume shifts, commodity supplies, standard services, undifferentiated features, competitive pricing can efficiently capture share.

Reduced price perception risk: Pricing too high creates sticker shock; pricing too low triggers quality concerns. Competitive pricing anchors expectations at market norms.

Autonomous AI agents are only as effective as the infrastructure behind them, which is why building reliable data pipelines matters, explained in this guide on why data pipelines are critical for scalable AI systems

Disadvantages and Risks

Margin erosion through competitive racing: The fundamental risk is competitors who either have lower costs or are willing to operate at lower margins. Following their prices down destroys your profitability without gaining sustainable advantage. I've seen B2B companies cut prices 30% to match competitors, only to discover those competitors were VC-funded and burning cash to buy market share.

Ignorance of your own cost structure: Competitive pricing can mask whether you're profitable at competitive rates. A services firm matching competitor pricing at $200/hour might be losing money if their delivery costs are $180/hour while competitors have optimized to $120/hour.

Commoditization acceleration: When multiple players compete primarily on price, it trains customers to evaluate on price alone. This erodes the entire category's ability to charge for innovation or quality.

Loss of premium positioning: Some customers actively seek higher-priced options as a quality signal. Automatically matching or undercutting competitors can exclude you from consideration by customers who use price as a screening mechanism for quality.

Vulnerability to irrational competitors: You may face competitors with different objectives, market share mandates, loss-leader strategies, or distressed liquidation. Matching their prices can be destructive.

Since agentic AI depends on trustworthy inputs, this breakdown on how DataHen ensures data accuracy for business success shows why data quality is a competitive advantage, not a nice-to-have.

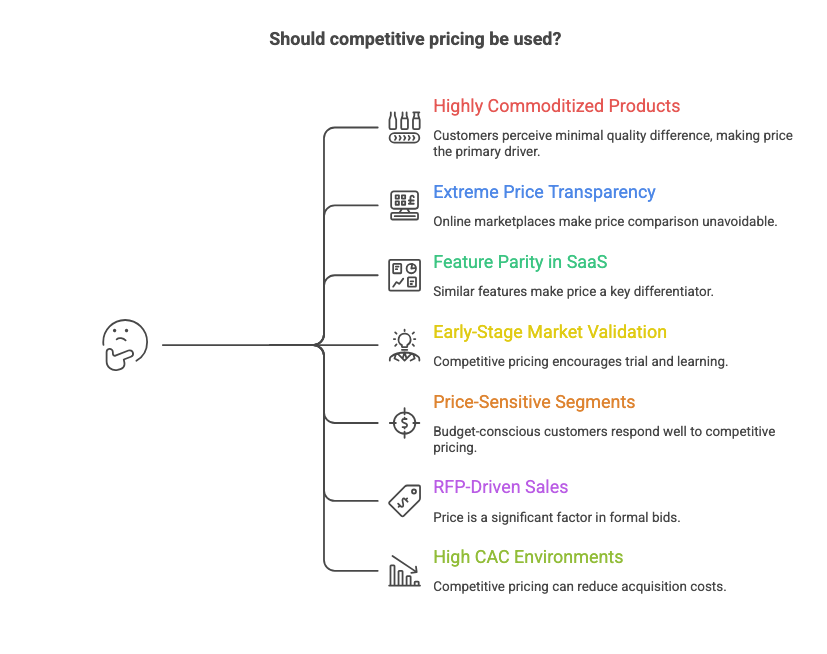

When Should You Use Competitive Pricing?

Competitive pricing isn't universally appropriate. It works in specific market conditions where price transparency is high, differentiation is limited, and customers actively compare alternatives. Understanding when competitive pricing is the right strategic choice prevents applying it where it destroys value.

Highly commoditized products. When customers perceive minimal quality difference between providers, basic office supplies, standard commodity ingredients, undifferentiated raw materials, competitive pricing is often the only viable approach. Customers won't pay premium for products they view as interchangeable. The strategic question becomes whether to price at parity or slightly below to capture volume.

Markets with extreme price transparency. Online marketplaces, comparison shopping engines, and aggregator platforms make competitive pricing inescapable. If customers see your price next to ten competitors' prices on the same screen, being significantly higher costs conversions unless you have clear differentiators visible in that moment.

E-commerce, insurance comparison sites, travel booking platforms, and financial products sold through aggregators all face structural price transparency that makes competitive pricing necessary.

One of the biggest risks with autonomous workflows is inconsistent structured data, which is why JSON Schema validation in data pipelines is essential for reliable AI-driven decisions.

Feature parity in maturing SaaS categories. When a software category matures, CRM, project management, email marketing, feature sets converge. Most providers offer similar capabilities, making it difficult for customers to justify significant price differences. Competitive pricing becomes the baseline expectation, with other factors (ease of use, integration ecosystem, support quality) determining which similarly-priced option wins.

Early-stage market validation. New companies testing product-market fit often use competitive pricing to remove price as a barrier to trial. The goal isn't profit optimization, it's learning whether the product solves problems customers care about. Pricing at or slightly below established competitors accelerates learning by increasing trial volume.

This is tactical competitive pricing with a deadline. Once product-market fit is validated, pricing should shift toward value-based approaches.

Price-sensitive customer segments. In markets with distinct price sensitivity by segment, budget travelers versus luxury travelers, small businesses versus enterprise, competitive pricing may be appropriate for price-sensitive segments while value-based pricing works for others. This requires disciplined segmentation to prevent leakage.

RFP-driven sales processes. Government procurement, large enterprise RFPs, and formal bid processes often include price as a weighted evaluation factor. While not pure competitive pricing, understanding competitive price positioning is essential for bid/no-bid decisions and competitive positioning.

High customer acquisition cost (CAC) environments. When customer acquisition is expensive, saturated digital channels, competitive sales cycles, high switching costs, competitive pricing can improve conversion rates and reduce CAC. If marketing costs $500 to get a customer to evaluate your product, losing them over 10% price difference is economically wasteful.

The decision framework: competitive pricing makes strategic sense when price is a primary purchase driver, differentiation is limited or invisible to customers at point of decision, and your cost structure allows profitability at competitive price levels. If any of these conditions don't hold, competitive pricing likely destroys value.

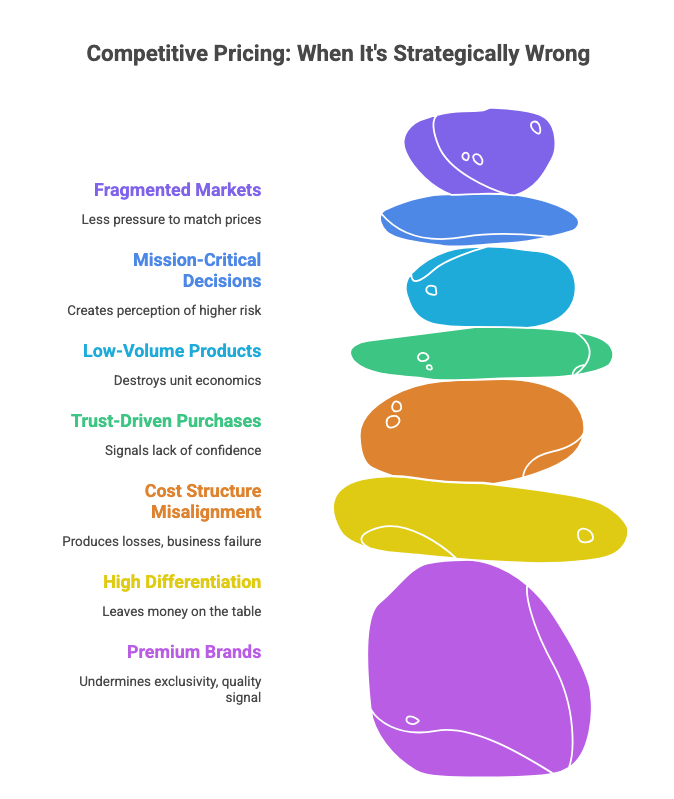

When Competitive Pricing Should Be Avoided

Just as important as knowing when to use competitive pricing is recognizing when it's strategically wrong. Applying competitive pricing in these situations erodes margins without gaining sustainable advantage.

Premium or luxury brands. Brands positioned on exclusivity, craftsmanship, or status cannot compete on price without undermining their core value proposition. A luxury watchmaker pricing competitively with mid-market brands signals "we're not actually luxury." Premium customers often use high price as a quality signal, lower prices reduce perceived value.

If your brand commands premium, competitive pricing abandons the positioning you've built. The correct strategy is maintaining price premium while investing in brand experiences that justify it.

As AI agents increasingly rely on live signals to act independently, real-time data collection tools and use cases highlight how businesses can stay responsive and adaptive.

High differentiation or IP-driven products. When you have proprietary technology, patented features, or unique capabilities competitors cannot replicate, competitive pricing leaves money on the table. Customers choosing you for specific differentiated capabilities will pay for them, you don't need to match alternatives that lack those capabilities.

Pharmaceutical companies with patent protection don't price generically available drugs competitively. Software companies with unique AI capabilities shouldn't price like conventional software. High differentiation earns pricing power; using it is sound strategy.

Cost structure misalignment. If your costs are structurally higher than competitors, less efficient operations, smaller scale, premium inputs, competitive pricing produces losses. The problem isn't your pricing; it's your cost base. Matching competitor prices when you can't match their costs is a path to business failure.

The correct response is either reducing costs to compete at market prices or differentiating enough to justify premium pricing that covers your cost structure. Competitive pricing with unfavorable costs is slow liquidation.

Trust and expertise-driven purchases. Professional services,legal, medical, strategic consulting, compete partly on price but primarily on expertise and trust. Clients choosing a lawyer don't simply pick the cheapest option; they evaluate track record, specialization, and confidence. Competitive pricing can signal lack of confidence in your expertise.

In expertise markets, premium pricing often correlates with perceived quality. Undercutting established competitors may attract price-sensitive clients but repel those using price as a quality proxy.

Low-volume, high-touch products. When sales involve extensive customization, consulting, or relationship development, the economics don't support competitive pricing. If you spend 40 hours understanding customer needs and designing solutions, you need pricing that covers that investment, following commodity pricing destroys unit economics.

Mission-critical or high-risk decisions. When customer failure costs are high, mission-critical infrastructure, safety systems, regulatory compliance tools, customers prioritize reliability over price. Competitive pricing can create perception of higher risk. "They're 30% cheaper" becomes "why are they so much cheaper?" in high-stakes purchases.

Fragmented markets with low price transparency. If customers don't easily compare prices, specialized B2B services, custom manufacturing, regional service providers, competitive pricing isn't necessary. You face less pressure to match competitors when customers aren't conducting side-by-side price comparisons.

The strategic signal: avoid competitive pricing when your value proposition, cost structure, or market dynamics reward differentiation. Competitive pricing in these contexts sacrifices margin for no strategic gain.

Competitive Pricing vs Other Pricing Strategies

| Strategy | Control | Profitability | Risk | Best Use Case |

|---|---|---|---|---|

| Competitive Pricing | Low – Prices follow market | Moderate – Margin compression risk | Medium – Vulnerable to price wars | Commoditized markets, high transparency |

| Value-Based Pricing | High – You set based on value | High – Captures value created | Low – Requires understanding ROI | Differentiated products, quantifiable ROI |

| Cost-Plus Pricing | High – You control margins | Predictable – Fixed margin % | Medium – May mis-price vs market | Custom manufacturing, project services |

| Dynamic Pricing | Medium – Algorithm sets prices | High – Optimizes for demand | Medium – Customer backlash risk | Perishable inventory, variable demand |

| Penetration Pricing | High – You choose discount | Low initially – Accepts sacrifice | High – May not hit volume targets | Market entry, network effects |

Value-based pricing sets prices according to economic value delivered to customers. A productivity tool saving customers $50,000 annually can price at $15,000 even if competitors charge $8,000, the ROI justifies it. This typically generates higher margins than competitive pricing.

Cost-plus pricing adds target margin to production costs. Works for custom products where competitive comparisons are difficult. Often combined with competitive pricing, using market rates as a ceiling check.

Dynamic pricing adjusts prices frequently based on demand signals, inventory levels, and competitor moves. Can incorporate competitive pricing as one input among several. Works best with perishable inventory or zero marginal cost digital products.

Penetration pricing deliberately prices below market to gain share quickly. Requires external funding to sustain losses or clear path to profitability once scale is achieved.

Types of Competitive Pricing Strategies

Price matching: Commits to matching any competitor price a customer finds. Works when you have cost structures that support profitability at competitor prices. Requires clear rules about which competitors qualify and verification processes.

Undercutting competitors: Systematically prices below market to capture share. Works when you have sustainable cost advantages that allow profitability below competitor prices. The margin versus volume tradeoff must make economic sense.

Parity pricing: Matches the market leader or median competitor price. Positions you as "equivalent" and competes on non-price factors. Works well when you have strong service delivery or customer success capabilities.

Loss-leader pricing: Prices select products below cost to attract customers who then purchase higher-margin items. Requires careful analysis of customer purchase patterns. Success metric is overall customer profitability including cross-purchase.

Tiered competitive pricing: Positions different product tiers competitively against different competitor offerings. Your basic tier matches low-cost competitors, premium tier competes with high-end alternatives. Requires genuine feature differentiation between tiers.

Common Mistakes in Competitive Pricing

Copying prices without understanding costs: Matching competitor prices when your cost structure is higher is the most dangerous mistake. If competitors have $30 costs at $50 price while you have $45 costs, you're in different economic positions despite identical prices.

Ignoring customer value perception: Customers don't buy based solely on price. A product priced 20% above competitors but delivering 50% more value is a better deal. Pricing competitively sacrifices margin on customers who would have paid higher prices.

Failing to update prices regularly: Markets shift, but companies that set competitive prices then leave them static for years drift out of alignment. Quarterly pricing reviews prevent gradual misalignment.

Competing only on price: The most destructive pattern is investing solely in price competitiveness while neglecting product, service, or brand differentiation. This creates race-to-the-bottom dynamics.

Treating all competitors equally: The regional player with 2% share influences price perception less than the market leader with 35% share. Prioritize competitive tracking based on who you compete against in actual deals.

Using list prices instead of transaction prices: Many B2B companies publish list prices but routinely discount 20-40%. Competitive analysis based on list prices misses actual competitive positioning.

Changing prices too frequently: Constant price changes create customer uncertainty and sales friction. Balance market responsiveness against customer experience.

Conclusion

Competitive pricing creates value in specific market conditions and destroys value when misapplied. It works in commoditized markets and price-transparent environments, but it's fundamentally a follower strategy. Sustainable competitive pricing requires either cost advantages that allow profitability below market rates or sufficient differentiation to selectively compete on price while maintaining premium positioning elsewhere.

The foundation of effective competitive pricing is accurate, timely competitor data. Without reliable pricing intelligence, even the best strategy fails in execution. Manual tracking breaks down as markets become more dynamic, prices change faster than spreadsheets can capture them, and transaction prices often differ significantly from published rates.

Ready to scale your competitive pricing intelligence? DataHen provides web scraping and data extraction solutions that deliver accurate, real-time competitor pricing data, so you can make informed pricing decisions based on actual market dynamics, not guesswork.

Get started with DataHen today.